Judge Questions New Employment Law

Introduction

In recent years, the subject of worker classification, gig economy, and employment laws have been the subject of ongoing legal and political debate. One such debate is over AB-5, a California Assembly Bill that recently went into effect on January 1, 2020. AB-5 seeks to determine who can be classified as an independent contractor versus an employee and established a presumption that most workers are employees and not independent contractors.

This article will explore AB-5 in detail, its impact on the gig economy, and how a judge recently questioned its constitutionality. This article includes updated information obtained from various reputable government resources.

AB-5: Understanding its Basics

Assembly Bill 5 (AB-5) is a piece of legislation passed by the state of California to determine whether a worker is an employee or independent contractor. The bill codifies the “ABC Test” set down by the California Supreme Court in the 2018 case of Dynamex Operations West, Inc. v. Superior Court. According to this test, a worker is presumed to be an employee unless all three of these conditions are met:

A. The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

B. The worker performs work that is outside the usual course of the hiring entity’s business; and

C. The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed for the hiring entity.

If a worker doesn’t pass all three parts of the ABC test, they are classified as a Part B worker and must be classified as an employee under California’s labor laws, including being provided with benefits and other protections granted to employees.

Impacts of AB-5 on the Gig Economy

AB-5 has generated significant debate, mostly due to its impact on California’s gig economy workers. Gig economy workers are those who provide services through independent contracting with firms like Uber, Lyft, and DoorDash. These companies provide less demanding service work and pay lower wages compared to traditional jobs. Such firms have argued that their services are not integral to their primary business model and, therefore, do not qualify them to be an employer.

AB-5 brought the debate around gig worker classification to the forefront in California. The law has provided clear guidance on who qualifies as an independent contractor by using the ABC test discussed earlier in this article.

Many gig economy companies have argued that AB-5 undermines their business model’s flexibility and will lead to higher costs that will be passed on to customers. Additionally, they also argue that AB-5 will negatively impact flexible work opportunities, ultimately harming the very workers that policymakers and lawmakers aimed to protect.

Judge Questions AB-5’s Constitutionality

In a recent decision, a San Diego judge provided clarity on a temporary restraining order sought by the gig-work industry Joint Applicants concerning AB-5’s compliance and constitutionality. The ruling provided relief in favor of the ride-sharing companies and sent the future of AB-5 on further trial. The judge questioned the law’s constitutionality, citing the media and a long history of case law that differentiated how the very Act treated various professions. Also, the judge stated that AB-5 unfairly excluded some of these professions from its coverage. Basically, the judge held that the law violated the California State Constitution’s guarantee of equal protection under the law.

The State stands to lose revenue if thousands of companies and freelancers challenge the law’s constitutionality successfully. The case has shown that the fight over AB-5 is far from over, and the legislature will have to consider how best to balance the needs of gig-workers and the broader economy.

Conclusion

AB-5’s goal is to provide a more robust definition of employment relationships for independent contractors’ protection. The law has been controversial, particularly in the gig economy industry in California. The new legislation’s impact will continue to be challenging for companies, and it remains to be seen how much it will benefit employees. Gig economy firms that spend significant amounts of time and money fighting AB-5 will explore how best to navigate the legislation’s requirements successfully. The ruling has thrown open the possibilities of more legal challenges in the future over AB-5’s constitutionality, and that case will be closely watched by gig economy workers, the companies who employ them, and all independent contractors in California and beyond.

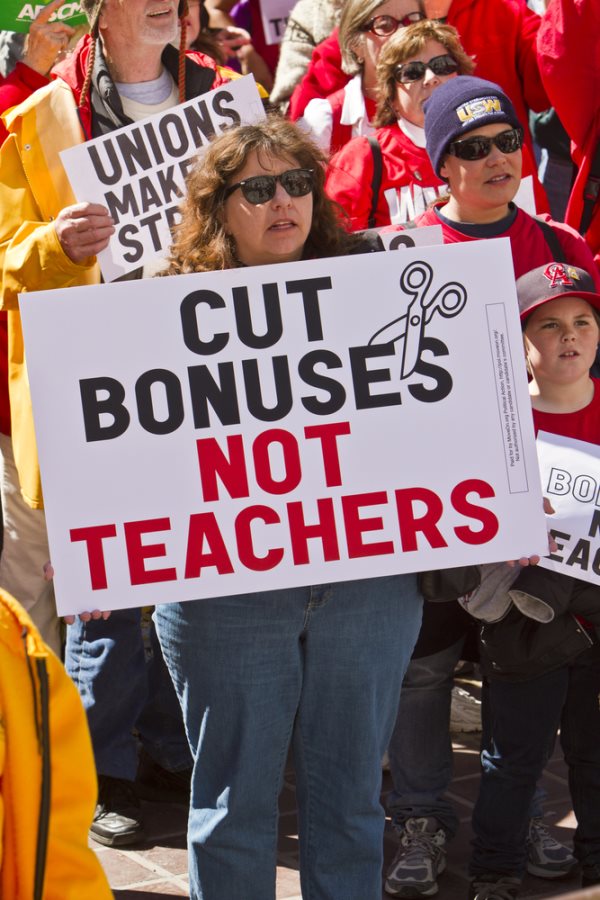

Tallahassee—A circuit judge harshly questioned fundamental elements of Florida’s decision to force state workers to pay 3 percent of their annual salaries for retirement costs, raising the prospect that the new law could be deemed unconstitutional.

Jackie Fulford, the Leon County Circuit Judge presiding over the case, left her seat on the bench this week to closely examine a courtroom chart depicting how worker’s retirement benefits would be affected by the implementation of a new law that would require public employees to contribute a portion of their pay to the state’s pension plan.

The law, which affects teachers, state workers and county employees, would also end a cost-of-living adjustment for future retirees.

Lawyers for the state of Florida defended the law—which potentially could save the state and its local governments more than 1 billion dollars—as the government’s right to manage the state’s finances by altering prospective pension benefits for public employees. Governor Rick Scott, who pushed for a 5% contribution, signed the bill into law earlier this year.

Judge Fulford questions whether the law, by requiring current state workers to pay percent of their salary to the fund, violates the “contract” between the state workers and their employers. Fulford has given no indication when she would render a decision on the case.